Paddy Power Betfair and FanDuel Enter Merger Agreement to Bring Together US Businesses

Paddy Power Betfair (LON:PPB) and FanDuel today announced a definitive agreement under which the companies will merge their US businesses, bringing together the leader in international sports betting and gaming and the company that redefined fantasy sports.

The transaction combines FanDuel’s world-class technology, well-recognized brand, and large, highly engaged user base with Betfair US’s existing TVG horseracing betting network and media business along with its online casino business in New Jersey. The combined business is incredibly well-positioned to capitalize on the sports betting market opportunity in the United States.

“We are excited to add FanDuel to the Group’s portfolio of leading sports brands. This combination creates the industry’s largest online business in the US, with a large sports-focused customer base and an extensive nationwide footprint,” said Peter Jackson, Chief Executive, Paddy Power Betfair. “The Group has leading sports betting operating capabilities globally and strong operations on the ground

in the US. Together with our substantial financial firepower, we believe we are now exceptionally well placed to target the prospective US sport betting opportunity.”

Bringing together the shared talent, expertise, technology, and resources of FanDuel and Betfair US allows the combined company to deliver even better features for sports fans, including new contests, new content, sports betting offerings, and an enhanced overall user experience.

The merged entity will invest in developing new products for consumers, an expanded workforce, and other growth opportunities. Together, the combined entity will also look for ways to drive revenue synergies, including cross-selling, and integrating aspects of the companies’ digital products.

“FanDuel and Betfair US share an enthusiasm for innovation and, as a result of today’s announcement, are prepared to lead the charge into the US sports betting market,” said Matt King, CEO, FanDuel. “The combination of our brands and team, along with a shared culture and vision for the future, will allow us to create the leading gaming destination for sports fans everywhere.”

The transaction is subject to customary closing conditions and regulatory approvals and is expected to be complete in Q3 2018.

Moelis & Company LLC acted as exclusive financial advisor to FanDuel, and Wilson Sonsini Goodrich & Rosati and Shepherd and Wedderburn LLP acted as legal advisors to FanDuel in relation to the Transaction. Goldman Sachs acted as exclusive financial advisor to Paddy Power Betfair, and Blank Rome LLP acted as legal advisors to Paddy Power Betfair in relation to the Transaction.

Read More

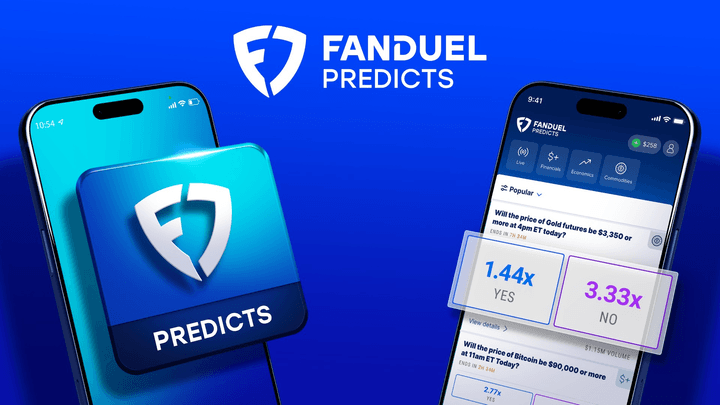

FanDuel and CME Group Launch FanDuel Predicts to Give Customers the Power to Trade on Tomorrow's Headlines

December 22, 2025

FANDUEL AND FANDUEL SPORTS NETWORK CONTINUE BROADENING STRATEGIC PARTNERSHIP WITH LAUNCH OF BET TRACKING ACROSS SELECT NBA AND NHL GAMES

December 16, 2025